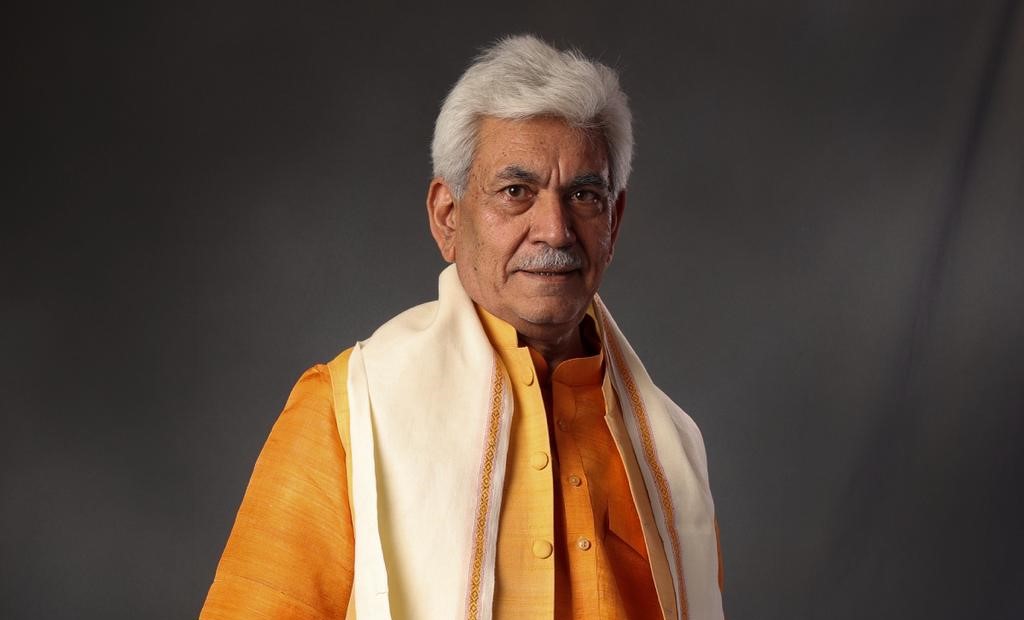

SRINAGAR: The Administrative Council (AC) which met underneath the chairmanship of Lieutenant Governor, Manoj Sinha gave its approval to the rolling out of JK Excise Coverage for the yr 2024-25.

Rajeev Rai Bhatnagar, Advisor to the Lieutenant Governor; Atal Dulloo, Chief Secretary; Mandeep Kumar Bhandari, Principal Secretary to LG attended the assembly.

A DIPR assertion issued to press reads that the Coverage highlights varied charges and duties to be applied within the manufacturing, transport, import and export of liquor and checking of the smuggling of narcotic medication to UT of JK from neighbouring States, Union Territories. The allotment of vends shall be made bye-auction and registration payment of Rs. 50,000/- shall be paid by bidders on-line by portal.

The profitable bidder might be required to deposit 100% of the bid quantity by eGRAS/Straightforward Gather portal inside seven banking days from the date of finalization of the bid. The vends not allotted for causes like social strain, courtroom orders or non availability of premises or the place no bids have been obtained shall be put to re-auction.

New initiative of linkage of minimal reserve bid value with sale potential of every vend has been accredited. Decrease cap of 15% of MSP of liquor for on premises consumption has been mounted. As notified in Excise Coverage for the yr 2023-24, Excise Obligation on CSD/ PAMF shall proceed to be 25% lower than that on civil for all sorts of liquor manufactured within the UT of J&Okay and the import responsibility shall proceed to be 15% lower than that on civil for all manufacturers of liquor. Current licensees having License of Beer Bar with Microbrewery License shall be given License inside similar premises on remittance of requisite license payment and different duties.

There might be full digitalisation in liquor manufacturing, distribution and sale from manufacturing until retail consumption. For acquiring property certificates, solvency certificates, the seller should apply inside 10 days of issuance of license earlier than the involved Income Authority who shall situation a certificates inside a interval of 1 month from the date of receipt of utility and in case of non-disposal of utility, the certificates as claimed by the applicant shall be deemed to have been issued by the competent authority.

Any licensee promoting liquor above MRP shall be imposed effective of Rs 40,000 for first offence and Rs 75,000 for the second offence.

#Approves #Up to date #Excise #Coverage

Kashmir Tourism

Kashmir News

Source Link