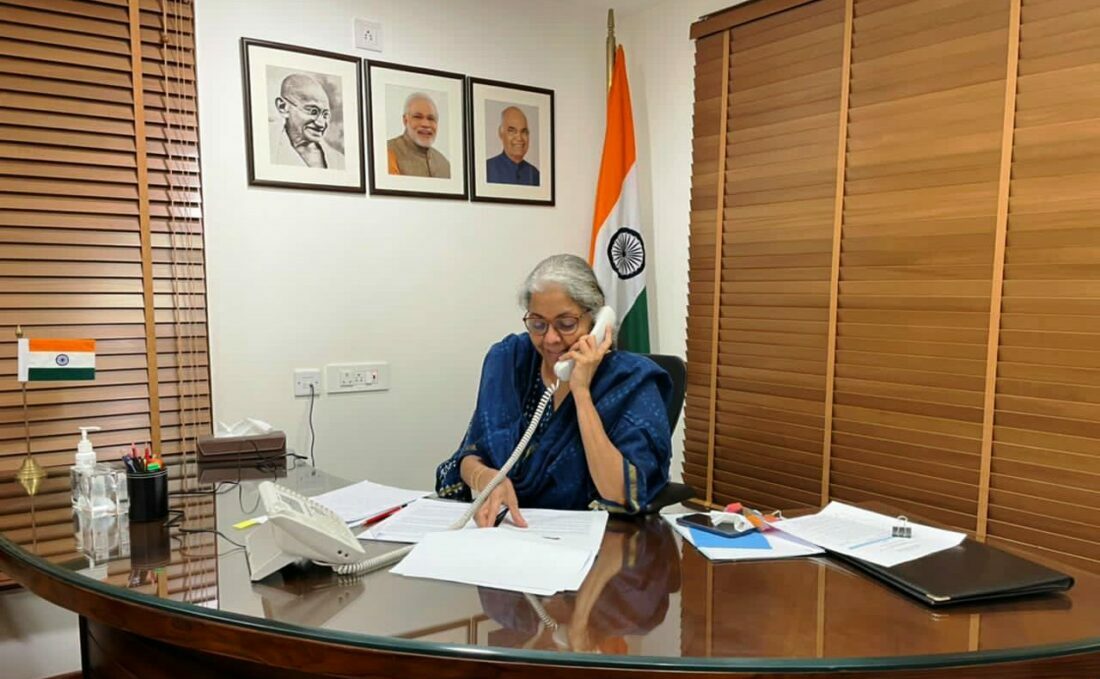

SRINAGAR: Finance Minister Nirmala Sitharaman, in her interim Price range presentation on Thursday, maintained the prevailing earnings tax slabs for the fiscal yr 2024-25. She additionally introduced a major withdrawal of excellent direct tax calls for, providing monetary respite to a big phase of taxpayers, studies showing within the media mentioned.

The Finance Minister declared that there could be no adjustments to the present direct and oblique tax charges, together with import duties.

Nonetheless, she acknowledged the burden imposed by unresolved direct tax calls for, some relationship again to 1962. Sitharaman proposed the withdrawal of excellent direct tax calls for as much as Rs 25,000 for the interval as much as the monetary yr 2009-10 and as much as Rs 10,000 for the monetary years 2010-11 to 2014-15. This transfer is anticipated to learn roughly a crore taxpayers.

Throughout her funds speech, Sitharaman supplied readability on the federal government’s strategy to earnings tax slabs. She reminded taxpayers that the brand new tax regime launched within the earlier yr’s funds could be the default, however people might nonetheless go for the outdated one. To additional ease the tax burden, she proposed a rise within the rebate restrict from Rs 5 lakh to Rs 7 lakh within the new tax regime. This adjustment ensures that people incomes as much as Rs 7 lakh yearly will likely be exempt from paying any tax.

The Finance Minister’s concentrate on tax slabs comes amid ongoing efforts to streamline the taxation course of and supply reduction to sincere taxpayers. Sitharaman highlighted the success of current measures, citing a drastic discount within the common time for processing earnings tax returns from 93 days in 2013-2014 to only 10 days within the final fiscal yr.

Whereas sustaining the established order on most tax-related issues, Sitharaman did make exceptions for startups and investments by sovereign wealth or pension funds. She proposed an extension of tax exemptions on sure earnings of Worldwide Monetary Companies Centre (IFSC) items, beforehand set to run out on March 31, 2024, now prolonged to March 31, 2025.

Because the Price range session of Parliament continues till February 9, taxpayers await additional particulars and clarifications on the intricacies of the interim Price range, notably concerning earnings tax slabs and the broader implications for his or her monetary well-being.

Defence continues to get the a lot of the allocations at Rs 622 lakh crore, adopted by Rs 2.78 lakh crore to Ministry of Street Transport and Highways; Railways received Rs 2.55 lakh crore; Ministry of Client Affairs Rs 2.13 lakh crore; Ministry of Dwelling Affairs Rs 2.03 lakh crore; Ministry of Rural Growth Rs 1.77 lakh crore; Ministry of Chemical substances and Fertilizers Rs 1.68 lakh crore; Ministry of Communications Rs 1.37 lakh crore; and Agriculture Ministry Rs 1.27 lakh crore.

#Tax #Reduction #Slabs #Stay #Unchanged